If Government Officials Set an Emissions Tax Too High

Emissions taxes restrict costs by allowing polluting sources to pay a tax on the amount they emit but because there are no emission limits taxes leave open the possibility that. Treasury Department proposed a carbon tax that would start at 49 per metric ton of CO2 equivalent in 2019 fairly close to the level the Interagency Working Group found for the social costs of greenhouse gas emissions.

How The Oil Industry Cast Climate Policy As An Economic Burden Grist

D pollution will be unabated.

. There will be too little pollution. To the right of e the marginal abatement cost bill D F G is greater than the tax bill D F so the firm will choose to pay the tax and generate emissions e - e. A 2017 report by the US.

The California deal increases the mileage standard and cuts greenhouse gas emissions by 37 per year. D there could be either too much or too little pollution. C the marginal social cost of pollution will exceed the marginal social benefit of pollution.

B there will be too much pollution. Pollution standards set specific emissions limits and thereby reduce the chance of excessively high damages to health or the environment but may impose large costs on polluters. A optimal b efficient c too low d too high.

This problem has been solved. There will be too little pollution. At that level coal prices would rise by more than 200 above.

The countrys dominant seller of new passenger and light commercial vehicles doesnt expect the Government to heed its advice on why impending emissions standards are flawed. If government officials set an emissions tax too high. On Monday announcing its official decision to reverse the rules said that those standards were too expensive for automakers to.

A pollution will be unabated. The efficient abatement level is achieved. The abatement cost to the pollution firm C D F.

Suppose government officials have set an emissions tax to reduce pollution. Acknowledging Bidens goal of cutting US. B the marginal social cost of pollution will exceed the marginal social benefit of pollution.

D there will be too little pollution. If government officials set an emissions tax too high. There will be too little pollution.

There will be little to no pollution b. C there will be too much pollution. The marginal social cost of pollution will exceed the marginal social benefit of pollution d.

The emissions tax is. B there will be too much pollution. A there will be too little pollution.

D both b and c. Suppose government officials have set an emissions tax to reduce pollution. WASHINGTON AP In a major step against climate change President Joe Biden is proposing a return to aggressive Obama-era vehicle mileage standards over five years according to industry and government officials briefed on the planHes then aiming for even tougher anti-pollution rules after that to forcefully reduce greenhouse gas emissions and.

Further suppose that with the emissions tax the marginal social cost of pollution exceeds the marginal social benefit of pollution. A carbon tax requires policymakers to explicitly define the fee on each ton of CO2 emissions typically on an annual basis. There will be too much pollution c.

Further suppose that with the emissions tax the marginal social cost of pollution exceeds the marginal social benefit of pollution. There will be too much pollution. Policymakers can use various approaches to set carbon tax rates.

There will be too much pollution. If government officials set an emissions tax too high. The emissions tax is.

Pollution will be unabated. That tax would incrementally increase to 70 per metric ton by 2028. If government officials set an emissions tax too high.

If government officials set an emissions tax too high. To achieve specific emissions outcomes. What would be the purpose of having a zoned emissions tax rather than a uniform emissions tax.

Further suppose that with the emissions tax the marginal social cost of pollution exceeds the marginal social benefit of pollution. The emissions tax is. There will be too much pollution.

The marginal social cost of pollution will exceed the marginal social benefit of pollution. Greenhouse gas emissions by at least half by 2030 the rules would begin with the 2023 car model year and start by applying Californias 2019 framework. Pollution will be unabated.

Government revenue D F. If government officials set an emissions tax too low. The marginal damage from pollution will exceed the marginal abatement cost.

B there will be too much pollution. Suppose government officials have set an emissions tax to reduce pollutionFurther suppose that with the emissions tax the marginal social cost of pollution exceeds the marginal social benefit of pollutionThe emissions tax is. A there will be too little pollution.

Higher tax rates mean larger emissions reductions revenues and price increases. Both b and c will occur. The IMF estimates a 75 a ton carbon tax will lead to the amount of emissions scientists estimate will correspond to 2 C of warming.

Requirements ramp up in 2025 to Obama-era levels of a 5 annual increase in the mileage. If government officials set an emissions tax too high. A there will be too little pollution.

If government officials set an emissions tax too high. Suppose government officials have set an emissions tax to reduce pollution. C the marginal social cost of pollution will be less than the marginal social benefit of pollution.

C the marginal social cost of pollution will exceed the marginal social benefit of pollution. The marginal social cost of pollution will exceed the marginal social benefit of pollution.

Econ Chapter 6 Flashcards Quizlet

Microeconomics Lecture 16 Flashcards Quizlet

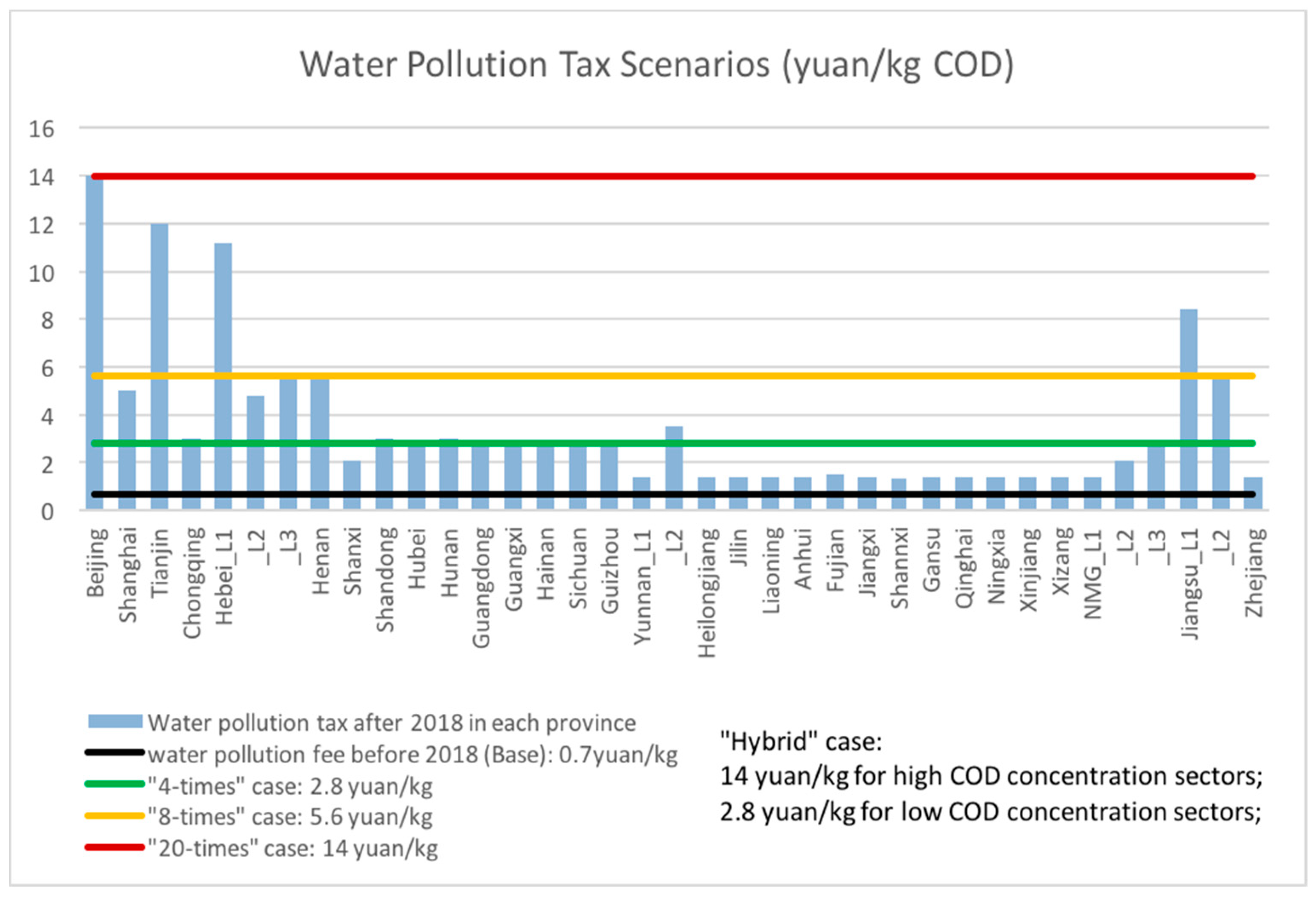

Water Free Full Text Industrial Water Pollution Discharge Taxes In China A Multi Sector Dynamic Analysis Html

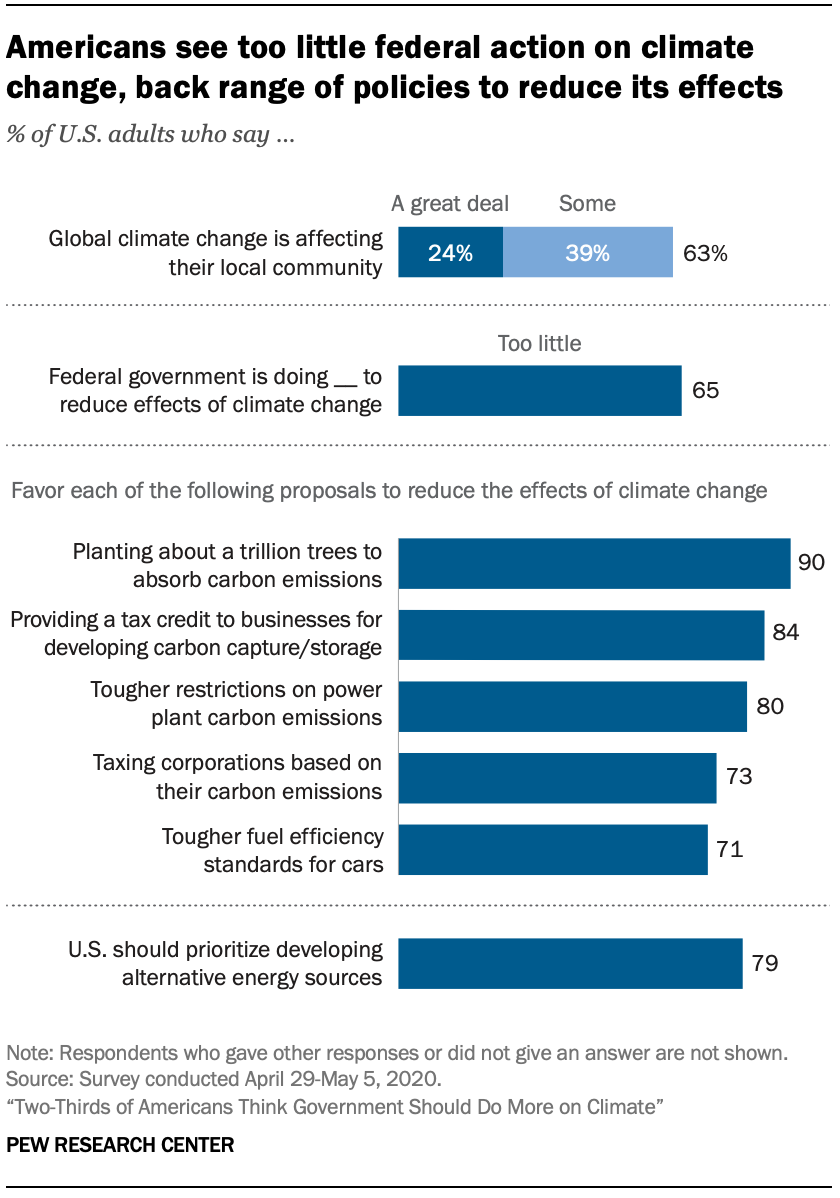

Two Thirds Of Americans Think Government Should Do More On Climate Pew Research Center

0 Response to "If Government Officials Set an Emissions Tax Too High"

Post a Comment